The Economic Offences Wing (EOW) of the Mumbai Police is relaunching its intelligence unit to combat financial crimes. This decision follows the Torres Jewellery Ponzi scheme, which came to light after duping investors out of INR 1000 crore. The scheme had been operating since February 2024 but remained undetected by multiple intelligence agencies.

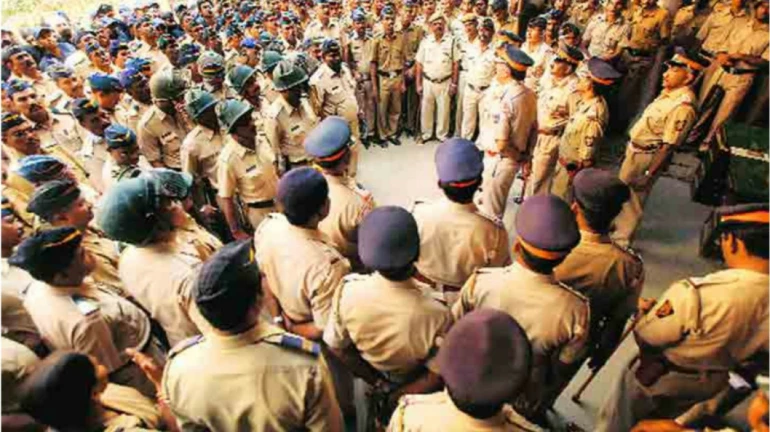

On January 6, a large crowd gathered outside the Torres Jewellery store in Dadar. They claimed they had been scammed in a multi-level marketing scheme. Foreign nationals, including individuals with Ukrainian passports, were allegedly involved. Police reports state that approximately 125,000 investors were affected by the scheme.

The EOW's intelligence unit was disbanded in 2020 due to corruption allegations. The unit was tasked with gathering intelligence on fraudulent schemes promising large profits. Its disbandment left the EOW without a proper mechanism to detect and prevent such crimes.

The unit was disbanded after corruption allegations. Its responsibilities were downgraded, and its officers were reassigned. Earlier, the team underwent frequent training to improve their ability to detect financial crimes. However, the recent scam has highlighted the need for such a unit.

The Torres scam exposed the gaps caused by the lack of intelligence gathering. As per reports, there was no prior intelligence or awareness of their activities.

The intelligence unit will now be reorganised. It will include four to six skilled officers with local intelligence support from officers stationed at each police station. These officers will gather information about suspicious schemes and relay it to senior officials. They will also monitor advertisements offering quick loans or high returns.

The unit will work closely with banks and financial institutions. It will coordinate with fraud and vigilance departments to find scams.