The Unified Payments Interface (UPI) which was majorly used for making online payments via mobile phones, now will be used for cardless money withdrawals as well. Yes, you heard it right!

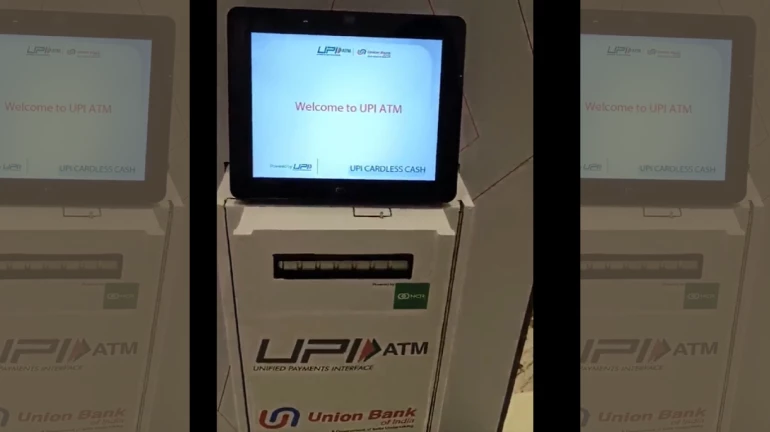

A ground-breaking UPI-ATM was unveiled on September 5 in Mumbai at the Global Fintech Fest 2023 which will enable cardless cash withdrawals for the first time. It is India's first UPI-ATM," which represents a substantial change in the nation's banking services. With this, there will be no need to carry physical ATM cards.

The National Payments Corporation of India (NPCI) and NCR Corporation collaborated to create this ground-breaking UPI-ATM.

A FinTech influencer named Ravisutanjani showcased a video demonstration to highlight how simple it is to withdraw money from this particular ATM.

#WATH UPI ATM, which allows cardless cash withdrawal, was demonstrated at the Global Fintech Fest which is taking place in Mumbai. At present, the feature is available only on the BHIM app.#UPI #BHIMApp #ATM #cardlessWithdrawal #GlobalFintechFest2023 #Mumbai #Maharashtra pic.twitter.com/Yn8nv3lzqi

— Ashmita Chhabria (@ChhabriaAshmita) September 7, 2023

Features of UPI-ATM:

Compatibility with a variety of systems

A transaction limit of up to 10,000 in line with current UPI daily limits and issuer bank's UPI-ATM transaction limits

Provides convenience by removing the need to carry an ATM card when withdrawing cash.

How To Make Transaction?

Customers of participating banks can use the UPI-ATM service, also known as Interoperable Cardless Cash Withdrawal (ICCW), to conveniently withdraw cash from any ATM that supports UPI-ATM capability without having to use a real card.

A customer will be prompted to enter the desired withdrawal amount when they choose the 'UPI cash withdrawal' option at the ATM. A distinctive and secure dynamic QR code will appear on the ATM screen after the amount has been input.

The customer only needs to scan this QR code using any UPI app and approve the transaction with their UPI PIN on their mobile device to complete the transaction and withdraw cash from the ATM.

Will It Reduce Cybercrimes?

A few characteristics of cardless ATM withdrawals make them more secure, even though they are not risk-free. Firstly, since you don't place your card into the ATM terminal, con artists cannot use skimmers to steal your card information. It serves little purpose for a hacker to steal a code created for cardless withdrawals since they are only good for one usage. Hackers wouldn't just need to know your PIN; they'd also need access to your phone because cardless withdrawals frequently need two-step authentication.

This UPI cardless withdrawal comes at a time when accusations regarding online fraud have been made frequently. In numerous instances of phishing, fraudsters have read card information by placing devices over the ATM card slot or by copying cards from data. Such fraudulent skimming would end thanks to cardless withdrawals via UPI.

Here's what experts say:

The speed at which India is digitising financial services & making them consumer-centric as opposed to corporate-centric (Alarm bell for credit card companies?) is simply dazzling. I just have to make SURE I don’t misplace my cellphone!" Mahindra posted on X.

This UPI ATM was apparently unveiled at the Global Fintech Fest 2023 in Mumbai on September 5. The speed at which India is digitising financial services & making them consumer-centric as opposed to corporate-centric (Alarm bell for credit card companies?) is simply dazzling.… pic.twitter.com/krBXhbc9Qh

— anand mahindra (@anandmahindra) September 7, 2023

NPCI stated that they are excited to empower clients with this cutting-edge and user-friendly ATM transaction upgrade. By seamlessly integrating the ease of use and security of UPI into conventional ATMs, the introduction of the "UPI ATM" will signal a key turning point in financial services. Without a physical card, this novel idea aims to make instant access to cash possible even in distant parts of India.