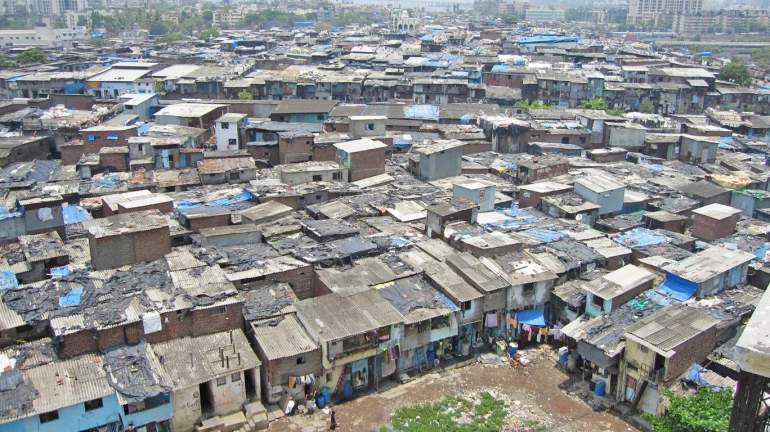

After two years of introducing ‘soft loans’ to boost the pending slum rehabilitation projects, it was learned that not even a single builder has benefited from the bailout scheme launched by the Maharashtra government.

Earlier, in October 2017, the Maharashtra government joined hands with the State Bank of India (SBI) to offer loans from ₹5 crore to ₹25 crores.

The tie-up between the state government and SBI happened through state-run Shivshahi Punarvasan Prakalp Limited (SPPL).

The ‘soft loans’ were launched for the developers, mostly mid-level builders, who have not been able to complete their construction or project due to shortage in funds.

According to a report published in Mumbai Mirror, the SBI will charge an interest of 9.5 per cent from the developers to complete their projects for sale. Moreover, the SPPL will provide loan at 8.75 per cent interest for rehabilitation components.

Also Read - BMC Partially Opens Up King's Circle Footover Bridge

The schemes by Slum Rehabilitation Authority (SRA) function on the subsidy model with incentive floor space index meaning that the developers construct homes for sale and also to rehouse slum dwellers free of cost.

However, developers raised concerns saying that 60 per cent of the saleable houses will be set aside for affordable housing while stating that this will be bad for the business.

In Mumbai, there are nearly 250 slum rehabilitation projects at different stages and the lack of fund is the cause for the same. Meanwhile, the officials informed that of the 15 builders who applied for the ‘soft loans’ under SRA, the loans of only four were approved.

Also Read - Charkop Car Depot To Now House Metro 7 And 2-A

Some of the developers have blamed strict condition for rejection of their applications for the loan. However, SBI spokesperson said that the bank approval of the same depends on several factors. SPPL officials have suggested that the scheme should be open to all the public sector banks.